OTTAWA — A promised federal wage subsidy to cover three-quarters of salaries will go to any company — large, medium or small — charity or non-profit that can show it has seen revenues drop sharply due to COVID-19.

The 75-per-cent subsidy on wages meant to cushion the blow from the pandemic will be available to employers that can show their revenues have fallen by at least 30 per cent due to COVID-19.

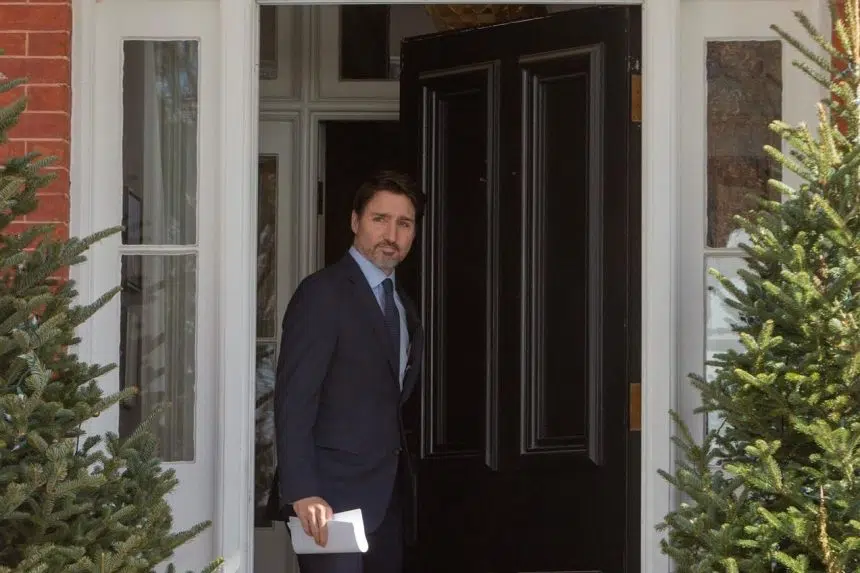

The wages the subsidy covers will be capped at $847 a week and backdated to March 15, Prime Minister Justin Trudeau said Monday.

Speaking outside his Ottawa residence, he said the size of the company or the number of employees will not bear on whether it qualifies for the help, in line with what other countries have done.

He asked companies that get the subsidy to rehire workers laid off over the last two weeks, and ensure that all the money through the program goes to employees.

Trudeau says companies that can pay their employees without federal help should do so, warning of consequences for businesses caught abusing federal financial aid — although he isn’t providing details.

He says the program will have to rely in some measure on employers sticking to the honour system when applying for help. He adds there will be an oversight system, but isn’t providing details today.

“We are trusting you to do the right thing. If you have the means to pay the remaining 25 per cent that’s not covered by the subsidy, please do so,” Trudeau said.

“And if you think this is a system you can take advantage of or game, don’t. There will be serious consequences for those who do.”

More of the details, including the estimated cost of the measure, will be available tomorrow, Trudeau said.

The details unveiled Monday came after days of criticism from a broad swath of business and labour groups over the original proposal of a 10 per cent subsidy, which they said fell well short of what was needed to avoid mass layoffs.

The federal bailout package to date is now valued at more than $200 billion, including $52 billion in direct spending, $85 billion in tax deferrals for individuals and businesses, and $65 billion in loans. Last week, TD Economics estimated the increased wage subsidy could add $25 billion in direct spending to the total.

Providing the wage subsidy to companies of all sizes that experience a decline in revenue should help prevent further layoffs and provide much-needed relief to employers and employees, said Goldy Hyder, president and CEO of the Business Council of Canada.

Dan Kelly, president of the Canadian Federation of Independent Business, said in a statement that keeping administrative requirements light should ensure support can get quickly to the businesses that need it.

Both groups said they would be looking for more details, including whether there will be a cap per employer over the duration of the program.

“The decisions to make the wage subsidy widely available to employers of all sizes and structures is the right approach given the unique nature of the COVID-19 pandemic,” Kelly said in a statement.

“The wage subsidy is the single best measure to help Canada prepare for a quick recovery the minute the emergency phase of the pandemic is over.”

But the CFIB also warned Monday that financial issues for other businesses are mounting. The organization suggested that one in five small and medium-sized businesses remain open during the economic shutdown linked to COVID-19, while two in five are worried about having to permanently close.

The CFIB suggests one-quarter of its members don’t think they can cover some of their fixed costs, such as rent and leases, for April, based on a survey of its members over the weekend.

Trudeau isn’t saying if the government is going to help with those costs, only that the Liberals will listen to businesses and non-profits that have problem and try to address them.

The Canadian Press