People in Saskatchewan are going to have to pay a few dollars more to be entertained starting in October.

As part of the 2022-23 budget released Wednesday, Finance Minister Donna Harpauer announced the provincial government will be imposing the six per cent Provincial Sales Tax on green fees and gym memberships as well as on tickets for sporting events, concerts, museums, fairs, movies and other entertainment events.

The additions align with items on which the GST already is collected.

Previously, the government collected PST only on items such as appliances, used cars, children’s clothing, home and auto insurance, restaurant meals, and renovations and repairs. It won’t be added to the cost of audio books.

The change is expected to generate $10.5 million in revenue this year and $21 million annually. Children’s activities, amateur events and activities run by schools or non-profit charities will be exempt.

That’s just one of the revenue generators the province added in the budget. It’s also increasing the education mill rate and the cost of tobacco products.

As of midnight Thursday, the cost of cigarettes is to increase by two cents per smoke, hiking the price of a pack by 50 cents. The cost of tobacco is to go up by eight cents per gram, and the price of heat-not-burn products is to rise by 1.3 cents per stick.

The government expects that to create $12.1 million in revenue annually.

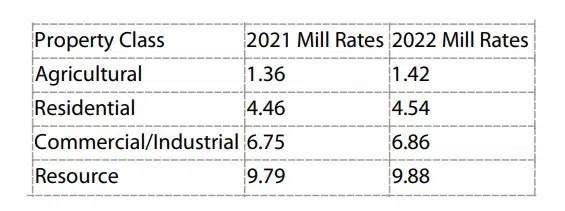

The mill rate for the education portion of property taxes is being adjusted across the board. Residential home owners will pay on average $13 more per year.

Those increases, combined with forecast base growth, are expected to total about $20 million in 2022-23.

Those hikes follow a hike in some fees announced last week, including on fishing and hunting licences and cottage land fees.

The budget is forecasting revenues of $17.2 billion, an increase of $2.7 billion from last year. The revenues include $8.1 billion from taxes and $2.9 billion from the sale of non-renewable resources thanks to higher oil and potash prices.

More revenue was generated in the third quarter than was forecast, which allowed the government to write down the operating debt by $450 million.

The total public debt is forecast to be $30 billion, up $2.3 billion from the forecast in last year’s budget.

Expenses are expected to be $17.6 billion, up $531 million from the 2021-22 budget.

That means a deficit of $463 million, which is about $2.1 billion lower than was forecast. Over the next three years, the government is forecasting deficits of $384 million in 2023-24, $321 million in ’24-25 and $165 million in ’25-26 before the budget is balanced in ’26-27.

As usual, the big three — health, education and social services — are the big-ticket items in the budget.

Health

Health gets a record $6.8 billion, an increase of 4.4 per cent from the previous year. The Saskatchewan Health Authority is to receive a record $4.2 billion this year.

The budget includes an increase of $21.6 million to address the surgical wait list that built up during the COVID pandemic — notably in areas that affect quality of life such as hip and knee replacements and cataracts.

The government’s goal is have the wait list down to pre-pandemic levels by March of 2025.

But Harpauer admits the province can only do that by increasing capacity and, for that, it needs more health-care professionals.

To that end, the province is spending to recruit and retain medical professionals through the creation of a new agency.

There’s $1.5 million for a plan to recruit 150 health-care workers from the Philippines and $3.5 million for the recruitment and retention of doctors, especially family physicians in rural areas.

The budget includes $17 million for the care of seniors, with $4.8 million for home-care services, $4.1 million for influenza vaccines, and $1.6 million for the Meadow Lake Community Lodge.

The government also is spending $6.5 million to add 117 more continuing care aides, who would join the 108 who were to be hired over the past year. Another 75 are to be hired in the next fiscal year.

The government is spending $12.5 million to add 11 ICU beds in the province, up from the 79 the province currently has – a number that was surpassed during the fourth wave of COVID-19. The goal is to get the number of ICU beds to 110 by 2024-25.

The budget includes $3 million to fund 10 new high-acuity beds at Regina’s General Hospital for patients with more complex medical needs.

Mental health and addictions programs are to receive $470 million, including $2.1 million for more spaces in high-needs areas. However, the province isn’t providing any funding for safe injection sites.

There’s an increase of $10.8 million for EMS to make sure communities — especially those in rural areas — have enough paramedics, ambulances and equipment.

The government has set aside $95 million for its pandemic response, which could be used for personal protective equipment and vaccination initiatives. The money also could be used to purchase COVID vaccines if a fourth dose was required by NACI.

Education

The education system is to get $3.8 billion in the budget, an increase of 1.3 per cent from the 2021-22 budget.

The province’s 27 school divisions are to receive $1.99 billion is operating funding, which includes funds to cover the two per cent salary increase for teachers that already had been agreed to.

The money includes $6 million for learning supports. In addition, there’s $7 million for 200 more full-time educational assistants.

There is $309.6 million as part of the federal-provincial agreement on child care as Saskatchewan aims to have $10-a-day child care.

The province is putting up $4.3 million to create 6,100 new child-care spaces as it looks to have 28,000 new spaces over a five-year period.

The government is paying an extra $4.9 million to post-secondary institutions for 150 new seats for training nurses.

Post-secondary institutions are to receive more than $684 million, with $38 million going to students’ supports.

Social services

The government is putting $1.6 billion into Social Services, an increase of 4.3.per cent from the previous budget.

The increase includes $11.4 million to raise Saskatchewan Income Support basic benefits by $30 a month and shelter benefits by as much as $25 per month.

There’s $3.0 million to increase benefits to seniors through the Seniors Income Plan, which will help low-income seniors with maximum payments to rise by $30 a month.

The budget also provides up to $11.5 million for the Saskatchewan Housing Benefit to help those with low incomes who are seeking housing.

Community-based organizations are to get $400 million, with $4.9 million for those who work with people with intellectual disabilities and $3.2 million for those supporting at-risk children, youth and families.

Crime

The province is putting $936.2 million into crime reduction initiatives, up 10.8 per cent from last year.

In terms of policing, the government is putting $50.7 million into a Provincial Protection Services branch, which is to unite conservation officers and other law enforcement officers into a single organization for improved co-ordination.

There’s $6.4 million for the Saskatchewan Trafficking Response Team, $3.2 million for crime reduction teams and $4.5 million for gang violence reduction initiatives.

Capital spending

The $3.2 billion in capital spending includes $156.6 million for health-care facilities, with $15.2 million for urgent care centres in Regina and Saskatoon, $13.5 million for the new hospital in Prince Albert, $6 million for the new Weyburn General Hospital, $6.5 million for long-term care beds in Regina, $3 million for a long-term care facility in Grenfell and $2 million for a long-term care home in La Ronge.

There’s $846 million for highways, with $479.5 million of that going to transportation capital projects. Planned work for the year including twinning projects on highways 3,6 and 39 and other work.

The government is investing $168.6 million in school renovations and new builds, including $95.2 million for the construction of 15 new schools and the renovation of five current schools across the province.

The budget includes $74.5 million for dams, water supply channels and irrigation projects, $286.6 million of municipal projects, and $56.4 million for courts and corrections.

The Crown corporations will spend $1.8 billion on capital and infrastructure projects.

Other areas

Saskatchewan’s film and TV industry will get help, with an $8-million increase for the Creative Saskatchewan Production Grant Program. That brings the total to $10 million.

The provincial government expects the investment to create an extra $50 million in production in the province.

Harpauer said after the province nixed the film tax credit, producers took their work to other provinces. The government hopes they’ll come back with the increased investment and do their work at the newly renamed John Hopkins Regina Sound Stage, in honour of the late Regina Chamber of Commerce CEO who was a strong advocate for the city.

Saskatchewan will invest $3.1 million in its overseas trade offices.

There’s $250 million in money dedicated to risks in agriculture, and $233 million in targeted investment for First Nations and Metis organizations.

The budget will provide $475,000 for the creation of the new Saskatchewan Indigenous Investment Finance Corporation, which will offer up to $75 million in loan guarantees for lending to Indigenous communities and organizations to invest in natural resources and value-added agriculture projects.

Bar and restaurant owners will benefit from a change in the VLT site commission rates, which increase from 15 per cent to 18 per cent. That’s expected to generate $6.7 million more for those with VLTs in their establishments.

The budget doesn’t include the decrease in the fuel excise tax for which the Opposition has been calling as the price of gas has risen.