The property values of homes, condominiums, apartments and businesses are being reassessed in Regina and that’s likely to impact municipal taxes for residents.

The process happens across Saskatchewan every four years as set out in provincial law and in 2017 all properties will have their assessment values updated. How much people pay in municipal taxes is directly tied to the value of their home.

Even though a property value might go up, it doesn’t necessarily mean more will be paid in tax.

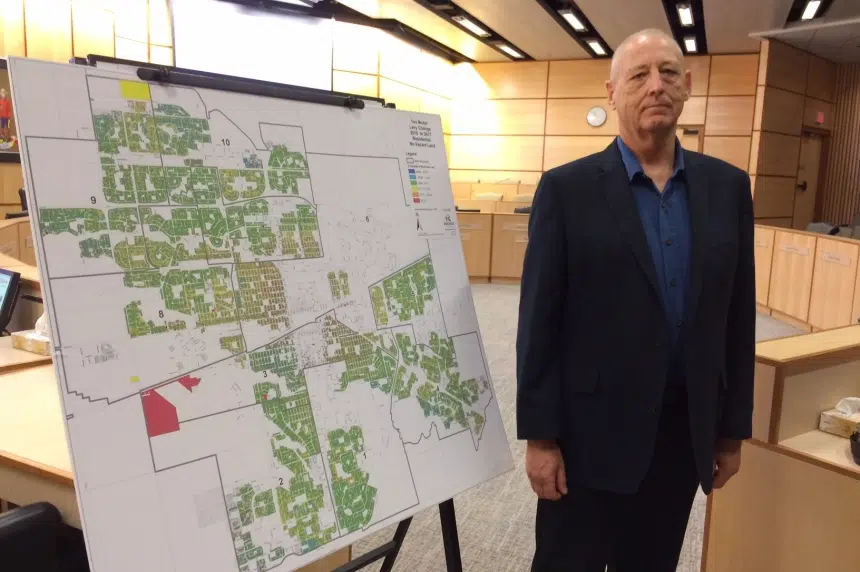

“Overall, the taxes are going to be redistributed so for every dollar that there’s an increase…somewhere (there) is a dollar of a decrease due to the reassessment,” explained Don Barr, the City of Regina’s director of assessment, tax and real estate.

He said 92 per cent of residential properties will see a tax change that falls into a range of as much as a 10 per cent increase to as low as a 10 per cent decrease.

Multi-family properties–such as apartments–will see quite a change in their market values, according to Barr. Taxes for these properties will increase between 20 and 50 per cent for most. Depending on the size of the complex, that could mean a significantly higher tax bill.

“On a per unit basis it might be hundreds. Certainly on a large complex it could be thousands.”

Barr added the reason multi-family values are changing so much has to do with increased rents and lower vacancies, which have led to increased prices.

Most condo units will also see property taxes rise by less than 20 per cent.

The updated values wouldn’t take effect until 2017.

“Council does have the option of looking at tax policy to mitigate any tax changes and that’ll happen in the first quarter of 2017,” Barr said, adding a phase-in approach is commonly used.

Letters will be sent out to homeowners and businesses the week of Aug. 29 to notify people of their specific changes.

“We’re going to send out letters that have the new assessment value, the old assessment value…it’ll give people a sense of whether their taxes are going up or down.”

If people don’t agree with their reassessments, they can appeal them.