OTTAWA — The federal government is speeding up financial help to low-income earners hit by the COVID-19 pandemic, with payments through the GST credit a month sooner than planned as it prepares to deliver billions more on benefits beginning next week.

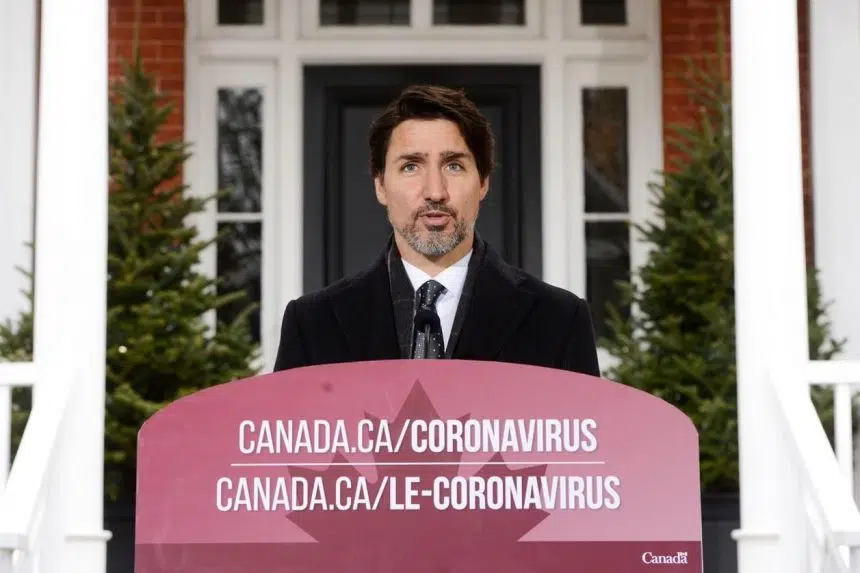

The government initially announced the money through the GST credit would be available in May, but Prime Minister Justin Trudeau said Friday that the money will be delivered this month.

Every qualifying adult will receive up to $300, plus $150 for each child. The parliamentary budget officer estimated in a report this week that the special GST credit payment will go to 13.2 million people and cost $5.67 billion.

More help is expected to arrive this month in the form of a new emergency benefit valued at $500 a week for up to 16 weeks.

An association representing Canada’s banks said they will help clients enrol for direct deposit from the Canada Revenue Agency, or update their account information with the federal agency, to speed up payments of federal financial aid.

Similar requests have gone out to businesses to sign up for direct deposit for prompt payments of a promised 75-per-cent wage subsidy, saving the time it takes to issue and process cheques.

Speed has been a thread through the economic shock from COVID-19 — how fast economic activity slowed down, the race to set up federal assistance programs, and now a drive to get money into people’s pockets quickly.

More than 2.1 million people have filed EI claims in the last two weeks, marking a dramatic shift in the labour force as economic activity is put on hold so people can avoid being in close contact to curb the spread of COVID-19.

A report Friday from RBC suggested the emergency benefit should fully replace or even exceed lost wages for hundreds of thousands low-income workers in the hard-hit retail, accommodation and food-services sectors.

Online applications for the Canada Emergency Response Benefit (CERB) open Monday, and anyone already approved for employment insurance benefits is supposed to be automatically moved over to the new benefit with no need to reapply.

MPs on the House of Commons finance committee were told Thursday that many of those who are receiving EI will get a bump in benefit when they are moved to the emergency benefit, on average about $200 more per week.

Receiving the emergency benefit won’t affect EI eligibility, meaning the 16 weeks won’t count against the time an eligible worker can receive EI benefits.

But exactly who gets moved over formed part of a critical letter the Opposition Conservatives sent Employment Minister Carla Qualtrough on Friday. Party critic Dan Albas cited contradictory statements between Liberal cabinet ministers and the government’s website on automatic enrolment, as well the effect on students and seasonal workers, and on EI premiums in the future.

“During a crisis, government communications must be clear, consistent and transparent,” Albas said in a release. “This has not been the case over the past few weeks.”

The RBC report, written by senior economist Andrew Agopsowicz, said many students won’t meet the requirement of having made at least $5,000 in the previous year needed to qualify for the CERB: “Given the costs already faced by new graduates during bad economic times, the lack of guidance from the federal government is concerning.”

Speaking at a midday press conference, Treasury Board President Jean-Yves Duclos said officials continue to work on some of the rough edges of the program so that, for instance, volunteer firefighters or municipal politicians receiving honorarium payments aren’t cut off from the CERB for violating the rule about having lost all their incomes.

Asked about students, Duclos said the promised wage subsidy would help companies hire students who may have otherwise faced a difficult job market.

While the subsidy should help some of employers rehire laid off or furloughed workers, many may still find the program “won’t be worth it” if it means they also have to pay the remaining 25 per cent, plus EI and Canada Pension Plan premiums, wrote CIBC chief economist Avery Shenfeld.

“An airline that isn’t flying doesn’t need flight attendants, a restaurant that’s closed doesn’t need waiters. For higher-paid workers, the subsidy covers even less of the cost,” he wrote in a research note Friday.

Jordan Press, The Canadian Press