When taxes make headlines, it’s usually because they’re going up. But not this time, at least for the majority of Regina homeowners.

That’s because 2017 is a reassessment year for all properties.

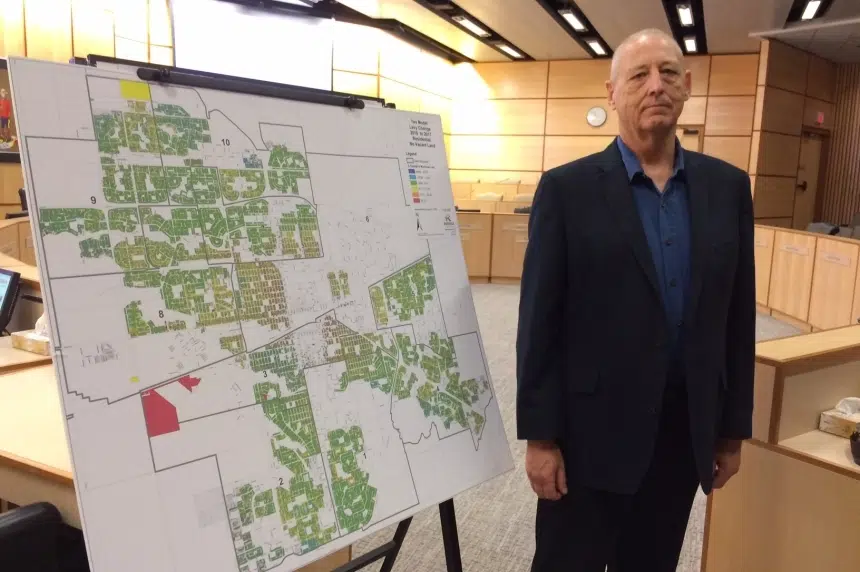

“The majority of residential property owners will see a decrease. There’s more properties decreasing than increasing with this,” outlined City Assessor Don Barr.

After giving the estimated rundown in August, Barr said finalized property value reassessment notices will be mailed out beginning Jan. 5.

Barr said 70 per cent of homeowners will see a property tax decrease. On average, he said that will translate into savings of $85 per property. The remaining 30 per cent of homes will be faced with an average hike of $75.

“Generally, the lower valued properties have increased at a higher percentage than the higher valued properties.”

Multi-family and commercial properties are increasing in value because the market for those properties has increased, Barr stated. These multi-family properties, like apartment buildings, are seeing the biggest change with an increase of about 27 per cent.

There are approximately 83,000 properties in Regina. The average assessment on residential properties is $350,000.

Appeals can be made two months after notices arrive. That starts with calling Service Regina at 306-777-7000. Barr said five per cent of commercial properties tend to appeal while only about one per cent of residential properties dispute their reassessments.

Assessments are based on current tax figures, and those are likely to change again after city council finalizes the budget in February.