While the Government of Canada seems ready to dig into its own coffers to help build homes across Canada, the Government of Saskatchewan doesn’t appear to be following suit.

On Thursday, the Liberal government in Ottawa tabled a bill to raise the GST rebate for purpose-built rental housing to 100 per cent – along with several other measures that were first announced last week.

They’re all in an effort to increase the supply of housing and thus help address both availability and affordability, which are big issues across much of the country, including Saskatchewan.

It doesn’t appear the provincial government is planning to join in, however.

Back in 2017, the Saskatchewan government expanded the PST and added it to construction labour. Ever since, those in and around the industry have been calling for that measure to be reversed.

The Saskatchewan NDP has also pushed hard for the tax to be dropped from construction labour.

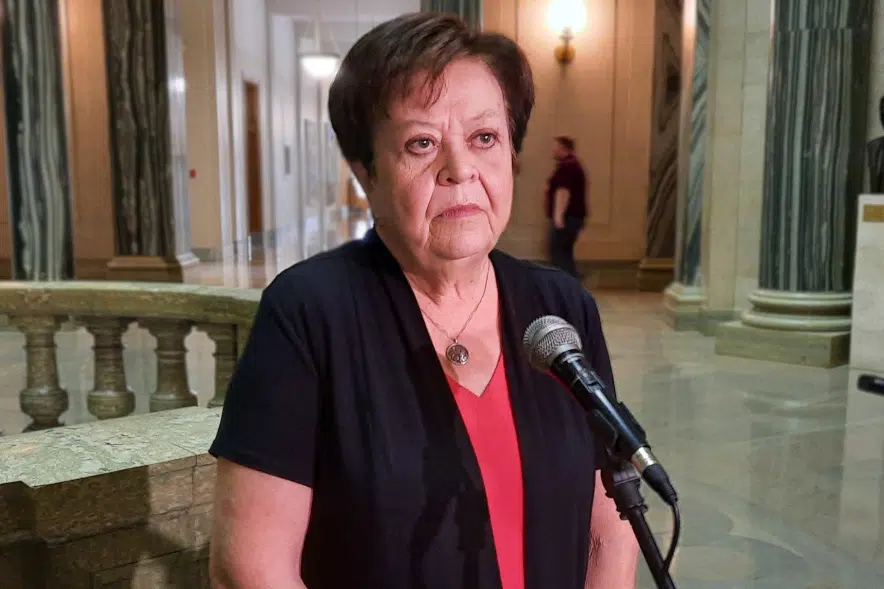

This week, when asked about Ottawa’s GST move, Saskatchewan’s finance minister didn’t give any indication she would be doing anything similar.

In a statement, Donna Harpauer explained that PST is applied to construction labour as part of a plan for the government to move away from relying on the relatively unstable revenue generated from natural resources.

“Our government believes that the broad application of PST ensures that a fairly applied, reliable, and sustainable source of revenue is available to finance vital public services,” the minister wrote.

Harpauer also said that Saskatchewan is the most affordable province in Canada when taxes, utilities and housing costs are taken into account, and the provincial government is working with the construction sector to address its current challenges and possible solutions.

The finance minister also took the opportunity to take a jab at the federal government, saying that if it’s going to make tax changes and expect other governments to follow suit, then it should do the same, pointing to Saskatchewan’s lack of a carbon tax.